-

READ MORE: Warren Buffett's Five Book Recommendations for 2025

Billionaire investor Warren Buffett has increased his holdings in a previously overlooked company, with its stock price rising 12 percent after the news surfaced.

As businesses join the Metaverse, big names are making a virtual splash. Companies like GEICO insurance, the manufacturer Duracell batteries, and Dairy Queen restaurants, the well-known ice cream chain.

Known as the "Oracle of Omaha," Buffett - who is worth a staggering $148 billion - is one of the most renowned investors in history.

As a result, other investors, both large and small, carefully observe his actions to gauge an idea.

That is why his interest in Sirius XM has drawn the attention of Wall Street investors. He first disclosed an investment in satellite radio and streaming service last year.

Between last Thursday and Monday, Berkshire Hathaway acquired another 2.3 million shares worth $54 million. As a result, Berkshire Hathaway now owns more than a third of Sirius XM.

Since Berkshire held more than ten percent, it was required to make the purchases public.

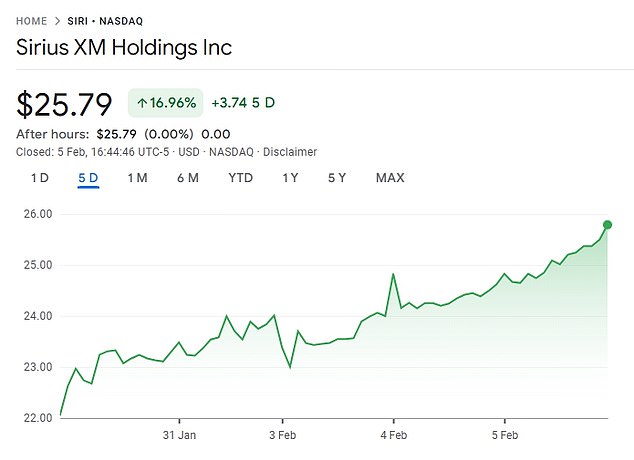

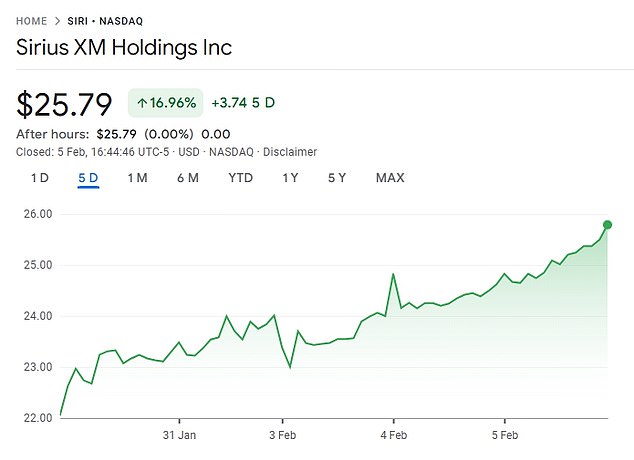

They made the announcement earlier in the day by filing with regulators on Monday evening, after which the stock price has climbed from $23 to $25.79, representing a 12 per cent increase.

Unlike traditional AM/FM radio, Sirius XM has subscription requirements, and it operates via satellite signals, providing coverage across the US and Canada, as well as remote areas. It also offers a streaming service for mobile and smart devices.

The decision followed Sirius XM Holdings' release of its fourth-quarter financial results, which exceeded market expectations.

Berkshire holds approximately 119.8 million Sirius XM shares - representing about 35.4 percent of the company.

Sirius XM, a satellite radio and online radio provider, has faced difficulties, but is now investing substantially in its podcast platform.

It had a cash stockpile of $325 billion by the end of the third quarter.

In Occidental Petroleum, VeriSign - and another batch of Sirius XM shares

The company purchased around $405 million worth of stock in Occidental Petroleum, a domestic oil company, approximately $113 million in Sirius XM, a broadcasting corporation, and about $45 million in VeriSign, a provider of domain name registry services.

None of these stocks had performed well last year, despite the overall market rising almost 26 percent, but they all surged after news of Berkshire's acquisition.

.

He had sold off vast amounts of shares in Apple and Bank of America stocks, and his cash reserve had skyrocketed to the highest margin since 1990.

Warren Buffett, along with his late business partner Charlie Munger, have consistently concentrated on maintaining a long-term approach with their stockholdings rather than working to predict market fluctuations.

Mr. Buffett has generated truly remarkable returns for his shareholders over the years.

Since Warren Buffett took over Berkshire Hathaway in 1965, he has achieved 20 percent annual gains. That is double the annual gains of the S&P 500 during the same period.

In the recent presidential election, the stock market has been experiencing unusually high fluctuations over the past few weeks.

Berkshire Hathaway announced on Friday that it has eliminated over 4,000 positions in the past 12 months, while the conglomerate headed by Warren Buffett is on track to report the highest annual operating profit in its history.

The filing did not provide information on which businesses have reduced or expanded their workforce.

As it countered underwriting losses, Precision Castparts cut 13,400 jobs in 2020 as the COVID-19 pandemic drove down demand for its aircraft parts.

Warren Buffett has led Berkshire since 1965 at the age of 31. The multinational conglomerate, based in Omaha, Nebraska, operates autonomously and Buffett is not involved in the daily activities of its affiliated companies.

Read more